+86 21 50907211

BD@immunofoco.com

HR@immunofoco.com

+86 21 50907211

BD@immunofoco.com

HR@immunofoco.com

BOHE Angel is the first life science and healthcare fund that is concentrated on the full cycle of business incubation in China. Its investors are a variety of pharmaceutical companies, include HENGRUI, Simcere, Tigermed, QILU PHARMACEUTICAL, BGI Group, WuXi AppTec etc., and individuals from executive positions of related pharmaceutical and healthcare organizations. BOHE ANGEL has invested in more than 30 bio pharmaceuticals with innovative technologies and products. It also initiated and established the operation of bio2(Beijing) and adock(Suzhou), two incubation centers that has brought tremendous fruits of the innovative technologies. The incubators are to provide the integrated service network and business environment for the entrepreneurs, and to accelerate the incubation and business transformation for the startup operations.

Zhen Fund has successively ventured in more than 800 entrepreneurial companies, and has cashed out their return through varies exit vehicles from more than 50 invested companies. From 2014 when Zero2IPO Research started “The Equity Investors Annual Ranking in China” for the early investment ventures, Zhen Fund has gained the first place of “Top 30 early stage investors in China” for six consecutive years.

“An extraordinary company that looks all over for those true entrepreneurs, to invent and guide the revolutions in the technology and to change the world“ was the motto by Xiaoping Xu and Qiang Wang when they started Zhen Fund. Zhen Fund has its core values of honesty and integrity, friendly and humility, affinity and kind, efficiency and idealism. It is highly recognized and appreciated by the domestic and international pioneers.

Zhen Fund has been keeping its momentum of being the stepping stones for the entrepreneurs, and spending in depth diligence being their partner throughout the rising journey.

Tao Capital is a major equity investor that is devoted to the medical science and healthcare. Its funds and resources are fueling the related dynamic companies’ exponential growth, to improve lives by providing advanced medical products and services. The total capital managed include eleven RMB funds and two USD funds. Tao Capital has 67 premium ventured projects, ten of those were listed on the Hong Kong Stock Exchange and SSE STAR MARKET between 2019 and 2021. It’s expected that in the next two years, ten more funded companies will be listed on the major domestic and foreign stock exchanges.

Delian Capital was founded in 2011, the programs under its spotlight are those positioned to deploy the cutting-edge medicines, deep tech, and those are driven by the latest technologies. In the advanced medical and healthcare industry, Delian Capital selects its possibilities with the “Science Based, Data Driven” fundamental concept, it identifies those premium market segmentation with the potential “Global Vision, China Driven” structures. It is primarily seeking the early investment opportunities in the third generation treatments (gene and cell therapy, gene editing, nucleic acids) and the IBAT(IT+AT+BT)sub tracks.

Yuan Li Fang Fund is a professional capital investor under the umbrella of Yuan Heng Xiang Corporation for the start up companies. Following the “healthy China” plan, its passion is value investing in life health, bio-pharmaceuticals, traditional Chinese medicines and longevity preservation. Featured investment portfolios include equity investment, merges and acquisitions. Its mission is to cultivate a number of unicorn enterprises to become backbones of the industries and the most influential tech leaders. It serves to promote the life science and healthcare industries, and to fulfill the demand of the vibrant health and quality of life.

Prudence Investment is fledged from the trinity of: numerous ventures of the primary shareholder Hubei Luojia Capital, the global capitol advisor Prudence Hong Kong’s domestic and foreign equity and debt funds portfolio, and its management team’s immense experiences in the primary and second market. It has been investing in the securities and equity markets since founded, and has successfully issued eight equity funds. The ventured network cover biotech and healthcare, advanced manufacturing, high-end equipment, information technology and big data, consumption upgrades etc. Example cases are Pharmaron, T3go, Huayun Info, SpeedChina, Top Ideal etc.

Adhering to the original intention of "benefiting the health and welfare of compatriots", and based on rich investment experience, strong financing ability, and excellent corporate governance level, JP CAPITAL integrates the upstream and downstream resources of the capital market to focus on private equity investment in the fields of bio-pharmaceuticals, medical care, medical services, and health management.

Utilizing rich exit channels, JP CAPITAL hopes to achieve three goals: growth of investee companies, value-added equity investments, and delivery of virtuous and fresh corporate targets to the capital market.

Founded in 2016, SDIC Venture Capital Co., Ltd. (SDICVC) is a fund management company founded by the State Development and Investment Corp. (SDIC), under a market driven governance structure.

SDICVC puts into practice the marketization and industrialization of the nation’s scientific and technological achievements, focusing on an investment strategy of "serving the national innovation strategy and focusing on the transformation of scientific and technological achievements". SDICVC puts its expertise and experience to work to achieve its goals of policy orientation and return on investment, faithfully implementing the national development strategy, striving to realize the synergy between the government, the society and the market, realizing its positioning as "an ideal, trustworthy, respected, influential partner” and its role as a leading professional venture fund management institution.

IN CAPITAL is an asset management firm that emphasis on healthcare industry. IN CAPITAL has an experienced professional team formed by people from healthcare and finance background. IN CAPITAL aims to promote the development of domestic healthcare industry, provides comprehensive asset management service, and helps entrepreneurs to make strategic decisions. IN CAPITAL maps its investments in healthcare service, medical device, biotechnology, in vitro diagnosis, and smart healthcare.

Guosheng Capital aims to become one of the most influential comprehensive financial service provider of the bio-industry in China, in order to establish and strength the biomedical industry chain.

The professional investment system of Guosheng Capital is around the trinity business development model of "equity + debt + comprehensive financial services". And continuously improve and promote the financial cooperation ecology of Chengdu Tianfu International Bio-Town.

Chengdu Capital Group Co., LTD. established in March 2021.It is established by Chengdu government with a new development stage, new development concept and new development pattern, focusing on the economic construction of Chengdu and Chongqing area, with a registered capital of 10 billion yuan.

The company has angel fund, VC, PE private equity manager license,professional operation of three core industries : fund investment, direct investment, value-added services,Focus on scientific and technological innovation and new economy, invest in core scientific and technological projects and major original technology transformation projects of universities and institutes, major technological innovation platforms with the world's top innovation resources, and industrial chain node enterprises with the transformation value of scientific and technological achievements. Form a life-cycle investment system for science and technology innovation projects covering the initial stage, growth stage and mature stage.The company gives full play to the leading and driving role of venture capital in urban scientific and technological innovation, promotes the on-site transformation of scientific and technological achievements and the comprehensive construction of new economic application scenarios, forms a collaborative and mutually beneficial innovation model of "R&D in universities and transformation in cities", promotes deep integration, accelerates the construction of a modern and open industrial system, and promotes the high-quality economic and social development of Chengdu.

Chengdu High-Tech Orinno Investment Group Co., Ltd. (hereinafter referred to as "Orinno Capital") was established in August 2022 with a registered capital of RMB 10 billion. It is a wholly-owned subsidiary of Chengdu High-Tech Investment Group Co., Ltd.

As a key industrial investment platform built by the Chengdu Hi-Tech Industrial Development Zone (CDHT), Orinno Capital is tasked with the mission of creating an RMB 300 billion industrial fund cluster in the Chengdu Hi-tech Industrial Development Zone in the next five years. Chengdu Hi-tech New Economy Venture Capital Co., Ltd. (hereinafter referred to as "New Economy Venture Capital", Asset Management Association of China Record-Filing No.: P1072349), a subsidiary of Orinno Capital, is the governing body for investment funds in Chengdu Hi-Tech Industrial Development Zone. The New Economy Venture Capital was established in October 2018 with a registered capital of RMB 5 billion.

Orinno Capital adheres to integrity and innovation, carries out the strategy of empowering the city through the manufacturing industry, and takes the solid promotion of industrial clusters and chains as a guide. It also has focused on three leading industries, i.e., electronic information, biopharmaceuticals, and digital economy, as well as cutting-edge technologies and advanced manufacturing, to build the "3+2" modern and open industrial system covering modern service industry and future industries for four business sectors, namely, industrial fund, industrial investment, industrial research, and industrial service, to take shape, and creates a "dual circulation" development pattern in which state-owned industrial capital reinforces high-quality development.

One of the very few teams that has the hands on experience to accomplish the full life cycle of a CAR-T drug development in China, from R&D to NDA application and approval.

Our top leaders average 10 years of industrial experience with their integrated capabilities and firmly bonded power together, covering the areas from R&D, manufacturing, quality control, clinical affairs, to new drug application and registrations.

We excel in bridging our partners and resources, to unleash the full potential of the capacities and assets from our collaborated clinical organizations, hospitals, research institutes and business partners. We embrace a vast concourse of learned people, keep our shoulders to the wheel and reach the destinations of our mutual interest.

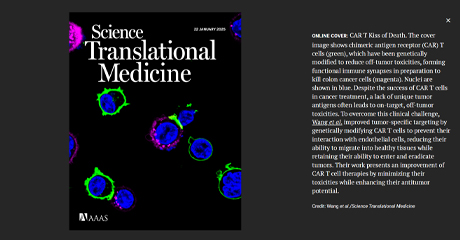

Innovative development strategy and innovative technology platform complement each other. Based on the clinical strategy, the FIC pipeline IMC001 targeting gastrointestinal tumors has entered IIT research. The RNAi technology platform Peri Cruiser® has undergone preliminary in vivo and in vitro validation.

We are rapidly advancing potential BIC product pipelines to clinical trials and commercialization with extensive industrialization experience. IMC002, a highly specific CLDN18.2 CAR-T received orphan drug designation from the US FDA in July 2022, and both the US FDA and China CDE approved its IND applications in March and April 2023 respectively.

Teamwork and high productivity. In no time, a systematic technology platform and multiple drug pipelines are formed. Within one year of the company’s operation, the first patient has been enrolled in IIT trial of IMC001.

2022 expected milestones: To finish the IIT dose esclation studies for one candidate; To complete an IND filing in both China and the US for a second pipeline candidate; To initiate the investigator initiated trial for a third pipeline candidate and reserve another pipeline candidate for IND filing in 2023..

+86 21 50907211

BD@immunofoco.com

HR@immunofoco.com

Unit 11,Bldg D,Jialilue Rd,Pudong New District,Shanghai,China

Unit 504-506,Bldg A3,Creative Industry Park, Xinghu Street

Suzhou Industrial Park, Jiangsu Province,China

Chengdu Tianfu International BioCity (Building 1, No. 8 Huigu Road, Shuangliu District)